QUOTES & PAYMENT PROCESSING

Insurance

Software designed for your business.

Whether you provide property, casualty, life insurance or any number of coverages, Thryv will modernise your business and help you manage your day.

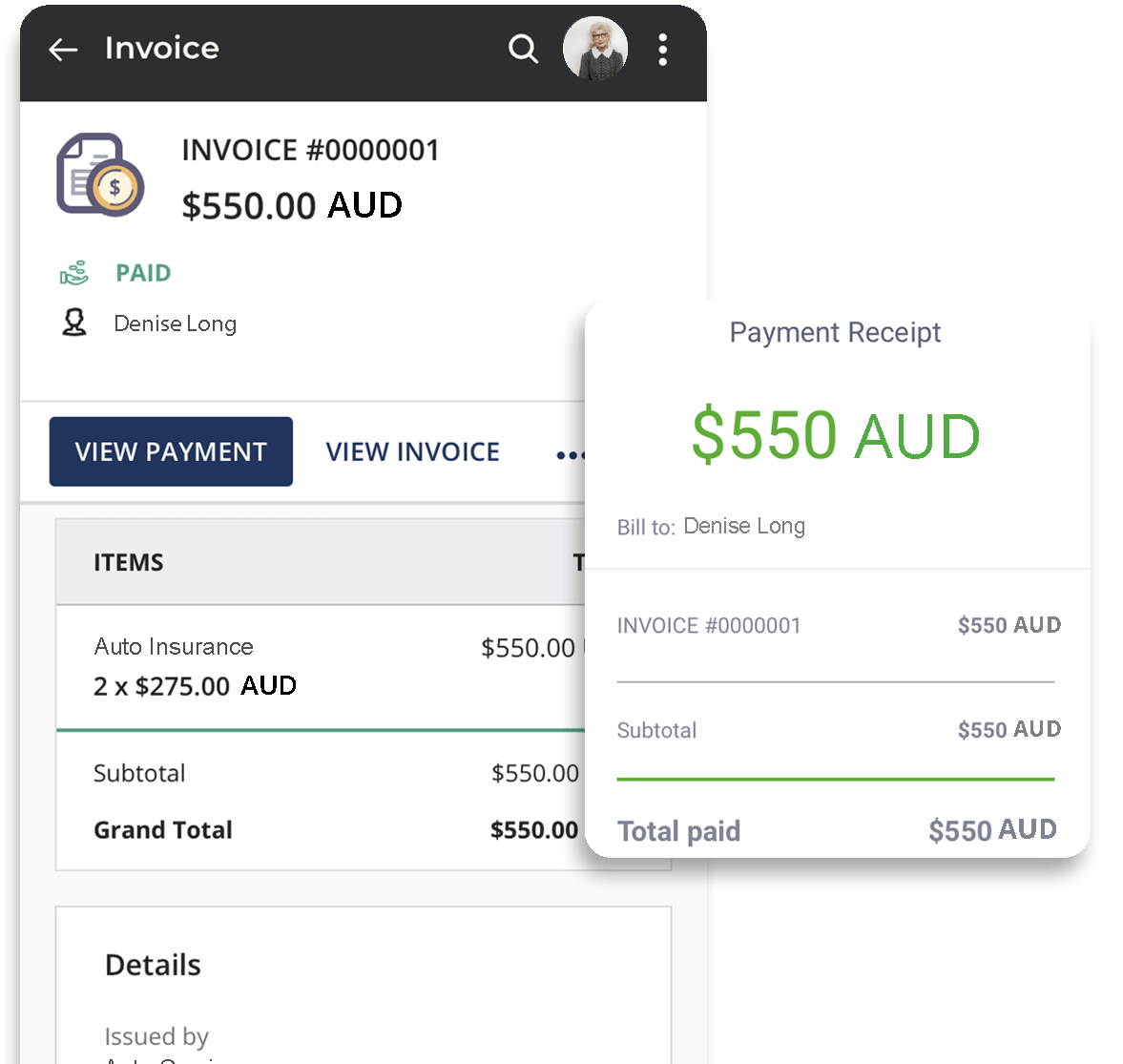

Create and share professional coverage quotes, and process premiums online.

Quickly send insurance and coverage quotes electronically. Share multiple estimates for comparison at once via a custom client login. Attach policy terms and conditions and other important documents for review. Process premium payments online, 24/7.

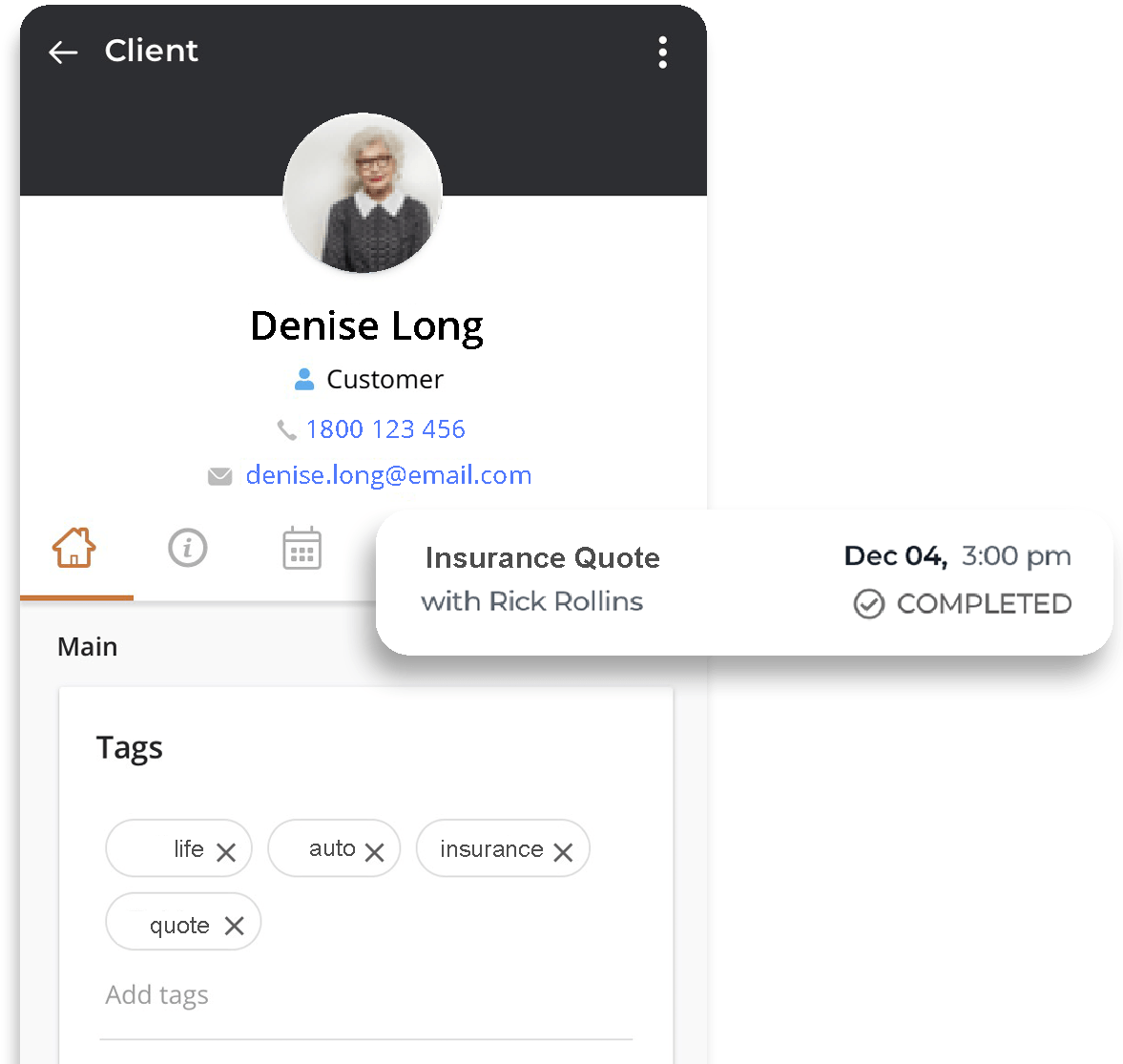

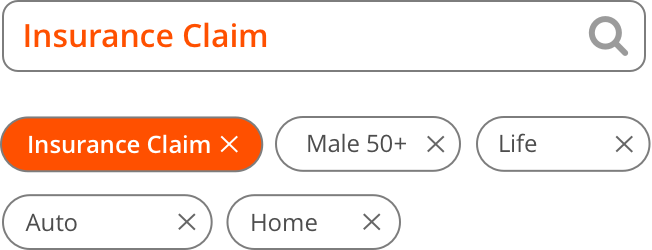

Organise lead and client information so you can nurture relationships.

Build stronger relationships with your clients by knowing more about your them. The Client Card includes customizable fields, data enrichment, and lead source helping you personalise your communication and conversations.

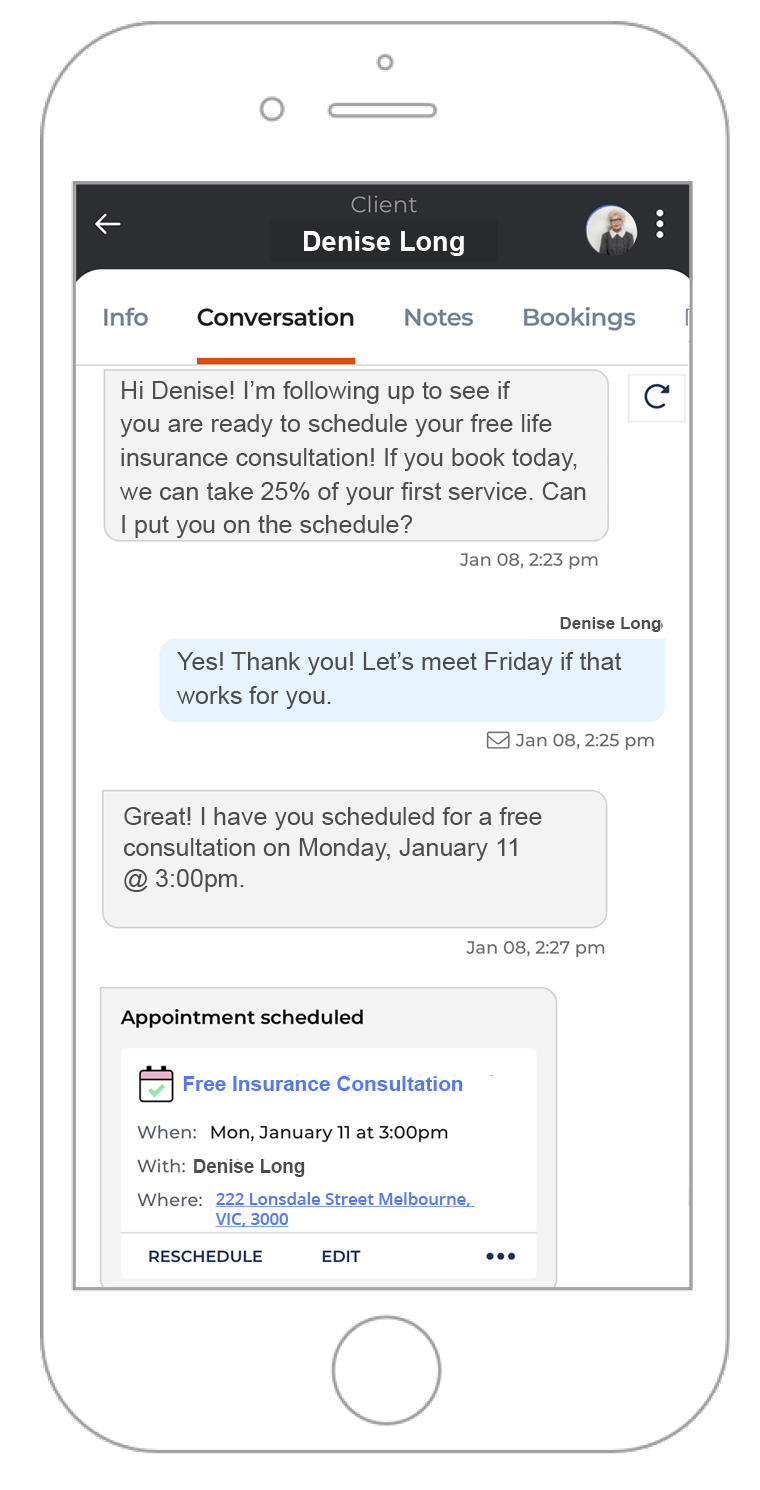

Stay top of mind with automated reminders and communications.

Deliver professional updates and reminders to your customers via text and email, while keeping all conversations organised and in one place. Establish your text-enabled business number so customers can easily respond and interact with you. Never forget to follow up again, with automated communications months in the future.